IRS FORM 4506T FOR FREE

An LITC must provide services for free or for no more than a nominal fee (except for reimbursement of actual costs incurred).

Under Internal Revenue Code Section 7526, the IRS awards matching grants to qualifying organizations to develop, expand or maintain an LITC. For every dollar of funding awarded by the IRS, an LITC must have a dollar of match. The funding and the period of performance for the grant will be Jan. The application period will run from May 8, 2023, to June 26, 2023. Taxpayers can check their eligibility for free using the IRS Offer in Compromise Pre-Qualifier tool.WASHINGTON - The Internal Revenue Service today announced it will accept applications for Low Income Taxpayer Clinic (LITC) matching grants from all qualified organizations. But "offer in compromise mills" can aggressively promote offers in compromise in misleading ways to people who clearly don't meet the qualifications, often costing taxpayers thousands of dollars. Offers in compromise are an important program to help people who can't pay to settle their federal tax debts. The IRS will make the final decision on whether to accept the taxpayer's application. Taxpayers can enter their financial information and tax filing status in the tool to calculate a preliminary offer amount. Taxpayers can see if they're eligible with the pre-qualifier tool Checklist of everything that's needed to submit a valid offer.

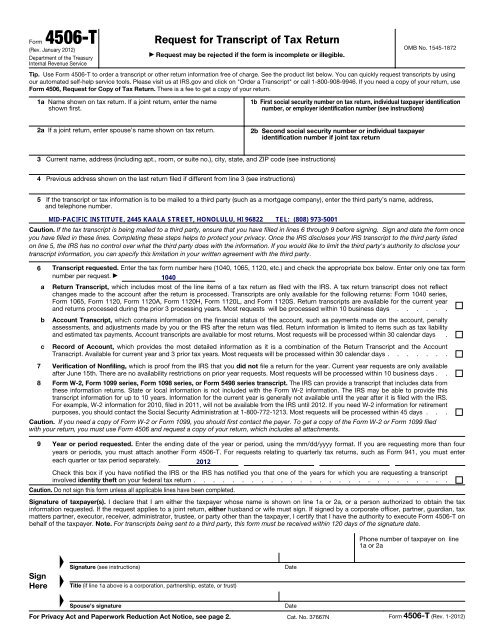

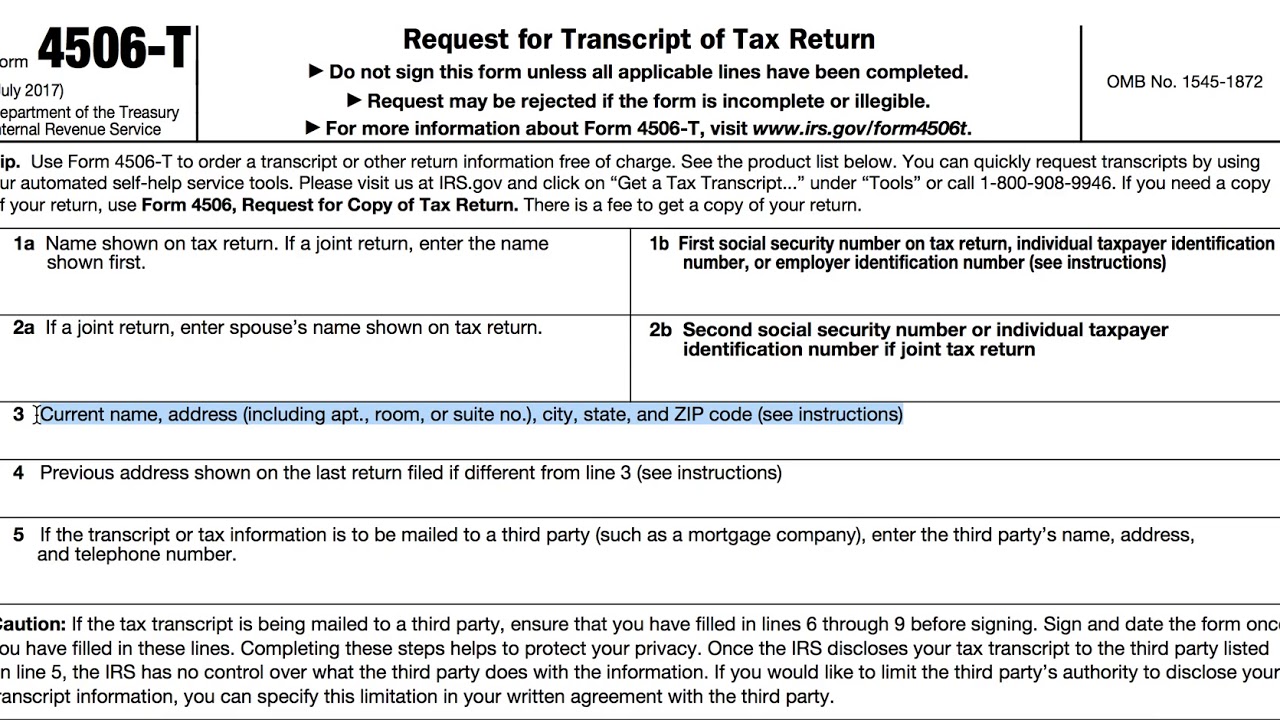

IRS FORM 4506T HOW TO

Step-by-step example of how to complete Form 656, Offer in Compromise.These are collection information statements which are required for both individual and business-related offers. Step-by-step guides for completing Forms 433-A and 433-B OIC.Overview of the OIC process, forms and pre-qualifier tool.The playlist has easy-to-find information that taxpayers need to know when they consider and apply for an OIC. The IRS has a free how-to video series on Offer in Compromise available in English, Spanish and Simplified Chinese. Taxpayers can also watch a how-to video series on Offer in Compromise Taxpayers should download and use the latest version of the OIC booklet to avoid processing delays. The booklet is also available in Spanish.

IRS FORM 4506T PDF

The booklet covers everything PDF a taxpayer needs to know about submitting an Offer in Compromise including: The Offer in Compromise Booklet has detailed information

When reviewing applications, the IRS considers the taxpayer's unique set of facts and special circumstances affecting their ability to pay including their: Low-income taxpayers don't have to pay this fee, and they should check if they meet the definition of low-income in the instructions for Form 656, Offer in Compromise. The application fee for an offer in compromise is $205. The goal is a compromise that's in the best interest of both the taxpayer and the agency. This agreement between a taxpayer and the IRS settles a tax debt for less than the full amount owed. When a taxpayer can't pay their full tax liability or if paying would cause financial hardship, they may want to consider applying for an Offer in Compromise.

0 kommentar(er)

0 kommentar(er)